Let me tell you about one of the most overlooked tax strategies of small business owners. First, however, it would be prudent to define who is a business owner. If you receive income as an independent contractor and are issued a form 1099-NEC at the end of the year then technically you are a business owner. If you operate a sole-proprietorship, partnership or corporation then you are a business owner.

In this article, we will discuss the advantages of having a home office for tax purposes. In the subsequent two articles we will discuss how to maximize the home office deduction for writing off your home as much as possible and how to maximize the vehicle deduction benefit even if you don’t have space for a full-room home office.

In 2017, President Donald Trump pushed forward his agenda of tax reform and the Tax Cuts and Jobs Act was the result. In this new tax reform, some changes were made that adversely affected New York and New Jersey taxpayers in a big way. The deduction for state and local taxes were capped at $10,000 and at the same time the standard deduction was increased to what is this year $27,700 for a married couple filing jointly. This eliminated the tax advantage of owning a home.

However, business owners have a way of circumventing that by creating a home office. The home office allows you to allocate the mortgage interest, real estate taxes, utilities and depreciation to the business for the part of the home used for the business. This creates a great opportunity to take an expense that offers you no tax benefit right now and create a potentially significant tax benefit from it.

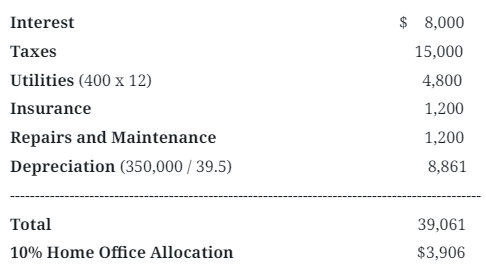

Just for illustrative purposes, a home with 10 rooms and 1 room is used for the home office (there are primarily 3 ways to calculate the home office allocation, sum of rooms is one of them and can be used if all rooms are similar in size). This allows for 10% home office allocation. Let’s assume the home was purchased for $500,000 ($350,000 for the house and $150,000 for the land – you cannot depreciate land) and carries a mortgage paying $8,000 of interest along with property taxes of $15,000. The monthly gas, electric and water bill is $400. The homeowners insurance policy is $1,200. Repairs were made on the heating and A/C systems totaling $1,200. This is how the home office expense would be calculated:

A business owner pays 15.3% self-employment tax, let’s assume you are in the 22% federal tax bracket and you pay 8% in state income taxes. This is a total of 45.3% in taxes. If you write off $3,906 that saves you $1,769.42 in taxes!

There is one more benefit to maintaining a home office and it relates to your business vehicle expense. Without a home office, when you leave your home and head to work you are commuting and the drive is not allowed to be deducted as a business expense. With a home office, you are now traveling between two places of business and this trip is now considered a business expense. This can have a significant effect on your vehicle expenses especially if you claim direct expenses which follow the percentage of business use for your vehicle. If most of your trips are between home and the office then this will swing the percentage of use from nearly 0% to nearly 100% business use.

To illustrate, let’s assume that your office is 10 miles away and you drive 20 miles round trip each day between home and the office. Let’s also assume that you do this 5 days a week for 46 weeks. That is 4,600 miles (20 x 5 x 46). At 65.5 cents per mile that is an expense of $3,013. Using the above tax percentage of 45.3% this creates a tax savings of $1,365!

Bottom line, not using the home office deduction could be causing you to pay significantly more taxes than necessary. However, there are a lot of rules surrounding how this deduction is taken and calculated and I encourage you to discuss your personal situation with a tax professional.